The Surprising Math Behind Claiming Social Security Early

- Joe Boughan

- Dec 13, 2025

- 10 min read

If you’re in your late 50s or early 60s and approaching your Social Security decision, you’ve probably heard a version of this advice more times than you can count:

“If you can afford to wait, delaying Social Security is always the responsible move.”

This article is for individuals who are actively preparing for retirement and want to make an informed, thoughtful Social Security claiming choice before filing.

The challenge is that most guidance around Social Security timing focuses almost entirely on one idea: waiting leads to a bigger monthly check.

While that’s technically true, it’s also incomplete—especially for retirees with meaningful savings in 401(k)s, IRAs, or brokerage accounts.

When you zoom out and look at Social Security as part of a complete retirement income plan, the math becomes more nuanced.

Claim Social Security Early or Wait? The Surprising Math takes into account potential portfolio growth, longevity, taxes, market risk, and even psychology all play a role—and all this can quietly shift the analysis in ways most people never see coming.

In this article, we’ll walk through:

The often-overlooked math behind claiming Social Security early versus delaying

A 15-year backtested example showing how different claiming decisions can affect a real retirement portfolio

Why common “break-even” charts leave out critical variables

And when delaying Social Security can still be the smarter, more secure choice

My name is Joe Boughan, CFP®, RICP®, and I work with individuals and couples preparing for retirement through Parkmount Financial Partners, a fiduciary wealth management and retirement planning firm based in Scituate, MA but serving individuals looking for a fee only financial planner locally in the Boston, Rhode Island, and Cape Cod markets, but also available across the country with our wealth management services.

If you’d like help reviewing how Social Security fits into your own retirement income plan, you can request a complimentary consultation here:

Why “Just Wait for a Bigger Check” Is Only Half the Story

Social Security’s rules are straightforward on paper:

Full retirement age (FRA) for most people retiring today is around 67. The Telegraph

You can claim as early as 62, but your monthly check is permanently reduced.

For each year you delay beyond FRA up to age 70, your benefit increases by roughly 8% per year. Financial Planning Association

That’s where the common advice comes from:

“Delay as long as possible. Bigger check = better decision.”

But that view leaves out at least three critical pieces:

Longevity reality – many retirees will not live long enough to reach the “break-even” age. Financial Planning Association+1

Portfolio opportunity cost – what happens to your investments when you spend them down while you wait for Social Security.

Sequence-of-returns risk – the danger of bad markets early in retirement when you’re drawing heavily from your portfolio. Schwab Brokerage+1

Let’s start with longevity.

Longevity & Break-Even: Many People Never Get There

When people ask, “Should I claim Social Security early or delay it?”, a common tool used by advisors is a break-even chart.

A break-even chart essentially says:

“If you claim at 62, you’ll get a smaller benefit, but you’ll receive it longer. If you delay to 70, you’ll get a larger benefit, but for fewer years. Here’s the age at which delaying ‘catches up’ to claiming early.”

For many claiming decisions, that break-even age lands somewhere in the early 80s—often around age 82–83 for someone delaying to 70. Reddit

Now here’s the uncomfortable reality:

A 2024 study in the Journal of Financial Planning titled “It May Be a Mistake to Delay Social Security Retirement Benefits” looked at this problem using updated life expectancy and return assumptions.

Using a reasonable 4% real (after inflation, after tax) rate of return, the authors found that if someone delays Social Security from 67 to 70, they generally need to live to about age 89 for delay to be financially optimal.

Yet, based on current life expectancy data:

Roughly three-quarters of men and about two-thirds of women will not live to that break-even age. Financial Planning Association+1

In other words, a significant share of retirees will never “recoup” the years of missed benefits needed to make delaying the mathematically superior choice—when considering portfolio dynamics.

That doesn’t mean delaying is always wrong. It means the decision is more nuanced than “bigger check later.”

A 15-Year Backtest: Claiming Early vs. Delaying in a Real Portfolio

To make this more concrete, imagine the following scenario:

It’s 2010.

You’re 62, just retiring.

You have $1,000,000 invested in a diversified portfolio—60% stocks, 40% bonds.

You need about $60,000 per year from your savings to supplement other income, adjusted for inflation over time.

You’re eligible for Social Security and facing three options: claim at 62, wait to 67, or delay to 70.

In this chart, we modeled two main approaches over the following 15 years:

Claim Early (Age 62)

Start Social Security immediately at a reduced benefit. (YELLOW LINE)

Because Social Security is covering part of your spending, you withdraw less from your portfolio in the early years.

More of your investments stay in the market, compounding.

Delay to 67 or 70

You get no Social Security for several years. (GREEN + BLUE LINES)

You fully fund your retirement spending from your portfolio during that time.

You do eventually receive a larger benefit, but only after several years of heavier withdrawals.

Assuming historical market returns over the last 15 years, the early-claimer’s portfolio ends up roughly:

$350,000 higher than the portfolio of someone who delayed all the way to 70, and

About $220,000 higher than the portfolio of someone who waited until 67 to claim.

*These figures are pre-tax and purely illustrative; taxes, fees, and individual circumstances would change the numbers. The chart you’ll see in the blog illustrates this backtest visually.

Additionally returns cannot be gauranteed in the future.

The important point isn’t the exact dollar amount; it’s the direction and magnitude:

Leaving more of your nest egg invested during strong markets can more than offset the “penalty” of claiming Social Security early.

That extra compounding means the person who claimed at 62 now has:

A larger portfolio to draw from in their late 70s

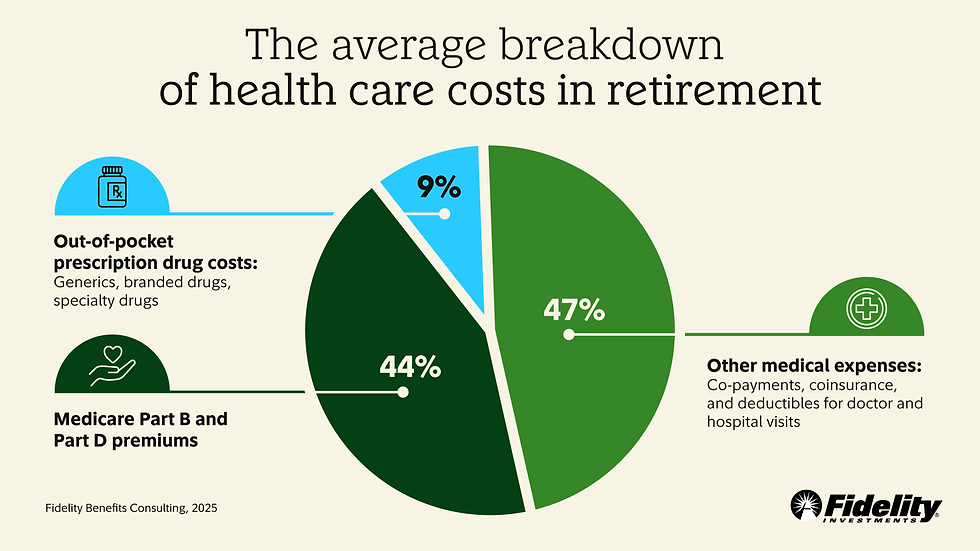

More flexibility for future healthcare costs, gifting, or leaving a legacy

A cushion against future market volatility

Again, this is a historical case study, not a prediction.

But it’s a powerful example of why the “just delay” narrative can be incomplete for retirees with meaningful savings.

The Hidden Force: Opportunity Cost

Behind all of this is a concept from economics called opportunity cost.

Charlie Munger, Warren Buffett’s longtime partner, once remarked that all rational decision-making should be grounded in opportunity cost—comparing any choice to your best available alternative.

In the Social Security context, the opportunity cost of delaying is:

“What could my portfolio have earned if I had taken Social Security earlier and withdrawn less from my investments?”

If you believe your long-term after-inflation and taxes portfolio return may be in the 3–4% range or higher, the cost of draining your portfolio during those early years becomes substantial. Financial Planning Association+1

Higher assumed returns → higher opportunity cost of delaying

Lower assumed returns → delaying becomes relatively more attractive

This is where behavioral finance sneaks in. Many retirees:

Overweight the certainty of a larger Social Security check (“I can see the bigger number”)

Underweight the compound growth they’re giving up in their portfolio (“I can’t feel the future growth I never let happen”)

It’s a classic case of present bias and loss aversion—we focus on the visible “gain” in benefits and ignore the less visible opportunity cost.

Sequence-of-Returns Risk: Why Bad Markets Early Hurt So Much

Now layer on another key risk: sequence-of-returns risk.

Sequence risk is the danger that poor market returns early in retirement, combined with withdrawals, can permanently damage your portfolio—even if long-run average returns eventually look “okay.” Schwab Brokerage+1

A simple analogy:

Think of your retirement portfolio at the start of your retirement like a young tree. If the first few years are calm and sunny, the roots grow deep, and the tree becomes sturdy. But if a major storm hits while the roots are still shallow, the chances of serious damage go way up.

Delaying Social Security while depending heavily on your investments exposes you more to this early-retirement storm risk:

You’re withdrawing more from your portfolio precisely when bad markets hurt most.

If the market drops early and you still need to pay the bills, you may be forced to sell more shares at low prices.

Even if the market recovers later, your portfolio may not fully bounce back because those shares are gone.

By contrast, claiming Social Security earlier can:

Lower the withdrawal rate from your portfolio in those early years

Help “protect the roots” of your investments while they establish themselves

Reduce the emotional pressure to abandon your strategy during downturns

From a behavioral perspective, having that additional predictable income early can also reduce anxiety and the temptation to make drastic portfolio changes at the worst possible time.

Some experts have even gone as far to say that more guaranteed income increases retirees' life satisfaction as they transition into retirement when they no longer depend on their paycheck.

There are other ways of "hedging" against sequence risk that should be a part of a broader retirement plan, but they do come with costs that will be more or less important depending on the social security strategy at play in the context of the retirement plan.

When Delaying Social Security Does Make Sense:

The Safety-First Approach

All of this doesn’t mean “everyone should claim early.” There are very real situations where delaying Social Security is a smart and intentional strategy.

A key framework here is the “safety-first” approach to retirement income.

Instead of asking, “How do I maximize my expected wealth?” safety-first retirees ask:

“How do I make sure my essential expenses are covered by reliable income, no matter what markets do?”

In that framework, delaying Social Security can make sense because:

It increases your guaranteed income floor—especially useful if you value certainty over maximizing potential upside.

It can reduce the need to buy expensive private annuities or load up on bonds.

If you live a long time, larger inflation-adjusted benefits may meaningfully reduce the risk of outliving your assets. Vanguard+1

Delaying can be especially compelling when:

You (or your spouse) have strong longevity in your family

One spouse has significantly higher earnings and you want to maximize survivor benefits

Your investment risk tolerance is low, and you’re more worried about worst-case scenarios than best-case ones

You expect relatively modest long-term returns from your portfolio

In those cases, you’re effectively trading some potential upside for a higher “worst-case floor”—and for many people, that’s a trade that feels worth making.

Taxes: The Quiet Tie-Breaker

Another factor that rarely fits neatly on a break-even chart is tax planning.

Strategic timing of Social Security can interact with:

Required minimum distributions (RMDs) from pre-tax accounts

Roth conversions before RMD age

How much of your Social Security benefit becomes taxable

Capital gains and portfolio rebalancing decisions

For example, some retirees may benefit from:

Delaying Social Security for a few years while doing Roth conversions at lower tax brackets, or

Claiming earlier to keep more assets invested in a tax-efficient account and avoid very large RMDs later.

The “right” answer is often highly personal and depends on current and expected future tax brackets, account types, and spending needs.

How to Think Through Your Own Social Security Timing Decision

Because there is no one-size-fits-all rule, a more helpful question than “Should I delay?” is:

“Given my health, my savings, my risk tolerance, and my goals, what trade-offs am I actually making with each claiming age?”

Here are some guiding questions to discuss with a fiduciary planner:

Health & Longevity

What does my family history suggest?

Are there significant health issues that might shorten or extend my life expectancy?

Portfolio Size & Allocation

How much of my retirement income needs must be funded by my portfolio?

Am I invested in a way that’s appropriate for sequence-of-returns risk?

Guaranteed Income vs. Flexibility

How important is it to me to cover basic expenses with guaranteed sources (Social Security, pensions)?

Do I value a higher floor or more upside potential and flexibility?

Taxes & Account Types

Do Roth conversions, RMDs, or other tax strategies favor claiming earlier or later?

How might my tax situation change if I delay Social Security?

Spousal & Survivor Considerations

Is there a big gap in earnings history between spouses?

Would delaying significantly improve the survivor benefit for a younger or longer-lived spouse?

Behavioral Comfort

How will I feel emotionally watching my portfolio fluctuate if I’m relying on it heavily while waiting to claim?

Will additional guaranteed income reduce my stress and help me stick to a sensible plan?

Bringing It All Together

In this article, we:

Looked at how the last decade and a half complicates traditional “always delay” advice

Explored why many retirees never live long enough to reach the break-even age from delaying

Walked through a 15-year backtest showing how claiming early can leave a portfolio significantly larger in some scenarios

Discussed opportunity cost, sequence-of-returns risk, and the safety-first philosophy

Highlighted how taxes, longevity, and risk tolerance all play a major role in Social Security timing

The real takeaway is this:

Social Security timing is not just about waiting for the biggest number on your statement. It’s about integrating that decision into your overall retirement income plan—your investments, taxes, longevity, and peace of mind.

For some retirees, claiming early provides more flexibility, less sequence risk, and a better emotional experience. For others, delaying is worth the trade-off because it builds a stronger guaranteed income floor and protects a surviving spouse.

Either way, it’s a decision worth getting right.

Want Help Stress-Testing Your Social Security Decision?

If you’re in your late 50s or 60s and trying to decide when to claim Social Security—and how that interacts with your investments, taxes, and retirement lifestyle—this is exactly the kind of work we do at Parkmount Financial Partners.

We’re an independent, fiduciary financial planning and wealth management firm based in the Boston area, and we also work virtually with clients in other states where we’re licensed or exempt.

If you’d like a thoughtful, data-driven review of your Social Security strategy and retirement income plan, you can request a complimentary consultation here:

We’ll help you evaluate your options, understand the trade-offs, and move forward with a claiming strategy that fits your life—not a rule of thumb.

Important Disclosures:

This article is for informational and educational purposes only and does not constitute personalized investment, tax, or Social Security advice. Past market performance does not guarantee future results, and backtested or hypothetical examples are inherently limited and may not reflect actual outcomes. Social Security rules and tax laws may change over time; consult the Social Security Administration, your tax professional, and a qualified financial planner before making any decisions about when to claim benefits.

Comments